The Big Idea with Ron Davis

February, 2010

A ‘Few’ Buying and Selling Tips

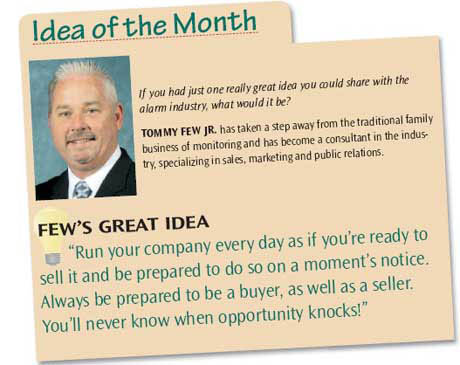

Tommy Few Jr. is not the same as Tom Few Sr. Senior passed away a couple of years ago and the industry and I lost a great friend. However, nature abhors a vacuum and sure enough his offspring have gone on to become entrepreneurs throughout the industry. While others in the family remained in the monitoring business, Few Jr. has taken the role of an industry consultant in California.

Anyone who is in the business of buying or selling companies, or assisting those who buy and sell companies, knows one thing: On any given day, a buyer is a seller and a seller is a buyer.

No matter how many waves of consolidation take place, it seems as though the statistics about the industry have remained the same — there are between 12,000-15,000 alarm dealers. My guess is that one-third of them are building a business, one-third of them are running a business and one third are in the process of going out of business, either through sale or because they don’t know how to run a business. It appears that no matter how many come in — or go out — the numbers remain constant.

If you are looking to buy, here are a couple of things to keep in mind:

- Make sure you have capital arranged for making an acquisition. It may cause you to spend a good deal of business time in doing so, but the last thing you want is the pressure of putting together a financial program for a time-sensitive acquisition.

- Make sure the acquisition and its profile is compatible with yours. While it doesn’t have to be identical to yours, compatibility still needs to be factored into the decision.

- When making a purchasing decision, always take a few days to think about whether this is something you really want to do.

If you are looking to sell, then here are a few things to keep in mind:

- Assemble your team ahead of time. That team should include a financial advisor, a lawyer and possibly a broker. Each of those people plays a unique role in the acquisition process.

- Go through your files and records looking for any errors of omission, including any unsigned contracts. Look at every aspect of your company, because a potential buyer will be looking at it with an eye to discount the purchase price.

- This is the best time to negotiate non-financial issues, such as personnel, insurance, consulting contracts and so forth. Think about what it is that you want to do.

- Remember that every day brings a new opportunity to do something exciting in this industry. Are you ready for it?

Ron Davis is Security Sales & Integration‘s “What’s the Big Idea?” columnist and contributing market analyst. He is president of Davis Group, a full-service consulting firm serving the security industry, which also includes GraybeardsRus. He has 35 years of industry experience, including founding Security Associates International in the 1980s.

Ron Davis is Security Sales & Integration‘s “What’s the Big Idea?” columnist and contributing market analyst. He is president of Davis Group, a full-service consulting firm serving the security industry, which also includes GraybeardsRus. He has 35 years of industry experience, including founding Security Associates International in the 1980s.

Ron Davis is Security Sales & Integration‘s “What’s the Big Idea?” columnist and contributing market analyst. He is president of Davis Group, a full-service consulting firm serving the security industry, which also includes GraybeardsRus. He has 35 years of industry experience, including founding Security Associates International in the 1980s.

Ron Davis is Security Sales & Integration‘s “What’s the Big Idea?” columnist and contributing market analyst. He is president of Davis Group, a full-service consulting firm serving the security industry, which also includes GraybeardsRus. He has 35 years of industry experience, including founding Security Associates International in the 1980s.